After debuting over 6 years in the past, Apple Card has been a little little bit of a nightmare for its associate financial institution, Goldman Sachs. They’re trying to exit, and whereas rumors aren’t crystal clear on the way forward for Apple Card, we’ll be recapping them right here.

Goldman Sachs losses

Before everything, Goldman Sachs is trying to offload the Apple Card partnership – and the highest contender, per latest studies, is JPMorgan Chase.

American Specific, Capital One, and Synchrony have additionally been rumored contenders. For the time being, although, they don’t appear to be more likely to take over the partnership. Amex CEO Stephen Squeri commented on the potential takeover again in 2023:

“As a result of that’s what you need a co-brand partnership for, is the distribution, as effectively,” Squeri mentioned. “And does it add worth to each manufacturers? And do you create premium economics? So, as we consider partnerships, that’s the lens that we use.”

Many individuals interpreted this as him taking pictures down the concept, as Apple Card’s present buyer base accommodates a variety of subprime prospects. To this point, the Apple Card partnership has value Goldman Sachs at the very least $1 billion, with whole Goldman Sachs client product losses totaling $6 billion.

Granted, not all of these losses come purely from credit score delinquencies. Apple Card can also be a really beneficiant product providing, with no international transaction charges, no late charges, no returned fee charges, as much as 3% money again on associate retailers, and 0% APR financing on Apple merchandise.

JPMorgan Chase takeover

Proper now, JPMorgan Chase is the “most well-liked alternative” for taking on the Apple Card partnership, per The Wall Road Journal. This report is from July, although it serves as the most recent information.

That mentioned, a deal is but to be signed. One of many key challenges with the takeover is Apple Card’s excessive share of subprime prospects.

Chase, for instance, has a subprime fee of round 15%. Capital One, who’s identified for being a subprime lender, has a fee of round 31%. For Apple Card, that fee is 34%, in line with the report. On this occasion, a subprime buyer is somebody with a credit score rating beneath 660.

Apple Card additionally has a delinquency fee of round 4%, increased than the common of three.05% throughout the bank card business.

For these causes, a deal will solely be made if a brand new lender can get it at a “enormous low cost.” Apple Card balances presently whole over $20 billion.

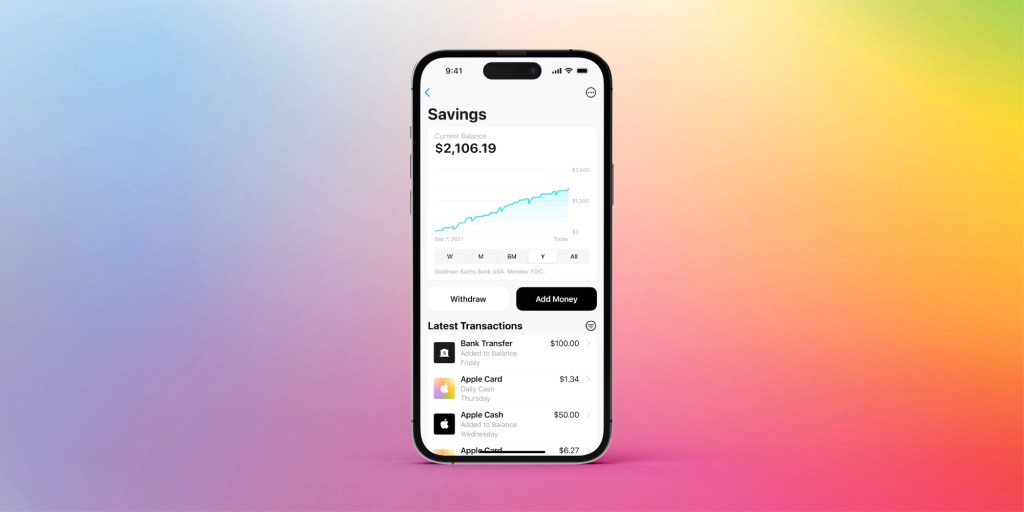

Apple Card Financial savings account

One key element being not noted of a lot of those discussions is the Apple Card Financial savings Account. That is additionally issued by Goldman Sachs.

When you do have to be an Apple Card buyer to carry an Apple Card Financial savings Account, the financial savings account doesn’t precisely have a singular tie-in with the Apple Card. You may select to have your Apple Card money again deposited into your financial savings account, however past that, there isn’t a deep tie.

Moreover, high-yield financial savings accounts aren’t a product that JPMorgan Chase gives. Perhaps they’d take it on only for Apple Card prospects, although I’d be shocked if that had been the case.

For the time being, Goldman Sachs continues to supply its Marcus by Goldman Sachs financial savings account product to the general public, regardless of a bigger pullback from the patron finance market. So, it’s believable that Goldman Sachs will proceed to supply the financial savings account, even when the precise bank card providing switches arms.

Wrap up

All in all, it appears extremely seemingly that the Apple Card partnership with Goldman Sachs will come to an in depth someday in 2026, after years of negotiations with varied lenders.

It isn’t fairly clear what it will imply for Apple Card, however given the excessive variety of subprime prospects and the entire losses seen so far, it’d be believable to imagine that Apple Card will change somewhat bit after a takeover. Late charges would seemingly be launched, and the product will doubtlessly develop into much less beneficiant general.

I do assume Capital One might be a robust contender for Apple Card if JPMorgan Chase finally ends up falling via. After their acquisition of Uncover final yr, they’ve a robust profitability benefit by being each a card issuer and fee community. This might doubtlessly offset among the sturdy losses with Apple Card presently. Solely time will inform, although.

My favourite Apple accent suggestions:

Observe Michael: X/Twitter, Bluesky, Instagram

FTC: We use earnings incomes auto affiliate hyperlinks. Extra.